Standard Energy Cockpit

Like an airplane cockpit, you have a general overview of your actual situation. Personalized market information and position reporting results in the perfect support to manage a flexible contract.

Market News

The German government plans to introduce a special levy to skim off 33% of windfall profits made by oil, coal and gas companies, which could generate revenue of between one and three billion euros, finance ministry sources told Reuters.

British North Sea oil and gas producers will spend around 20 billion pounds ($24 billion) on dismantling over 2,000 unused wells and facilities in the ageing basin over the next decade, an industry group said on Tuesday.

France will spend 8.4 billion euros ($8.67 billion) to help companies pay their energy bills, in a bid to cushion the impact of rising electricity and gas prices and help them compete with German businesses, its finance minister said on Saturday.

Germany wants to give an additional 5 billion euros' ($5.1 billion) worth of credit to the nationwide gas market trading hub to enable forward sales from gas storage facilities, according to a finance ministry document seen by Reuters.

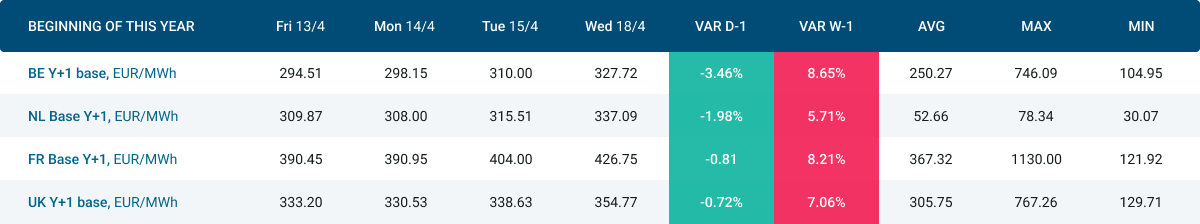

Statistics

The Energy Cockpit brings personalized information to your internal or external client base — a fully operational, interactive communication platform, including price charts, trends, and the latest market news.

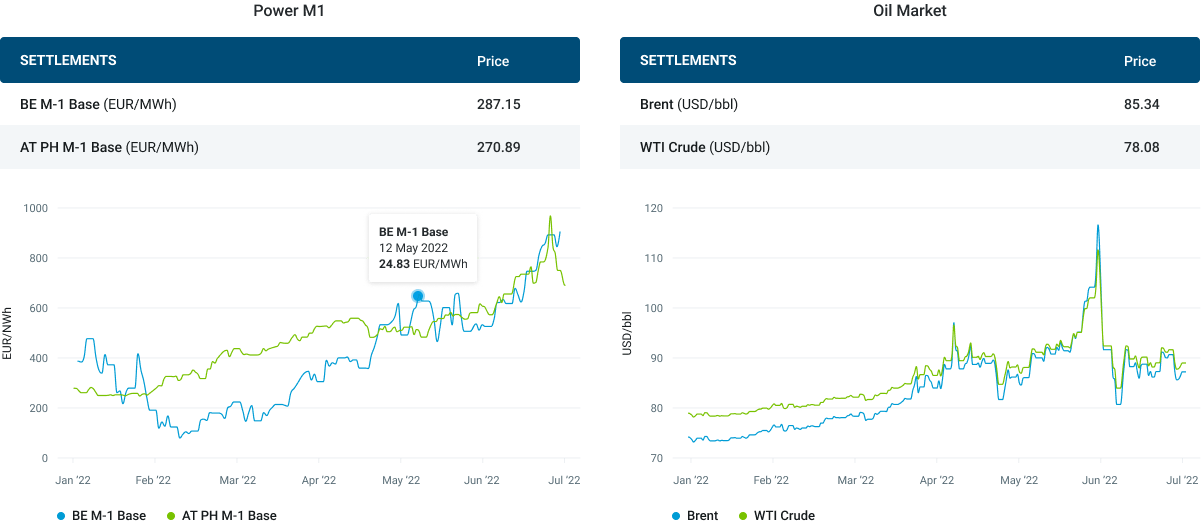

Market Prices & Trends

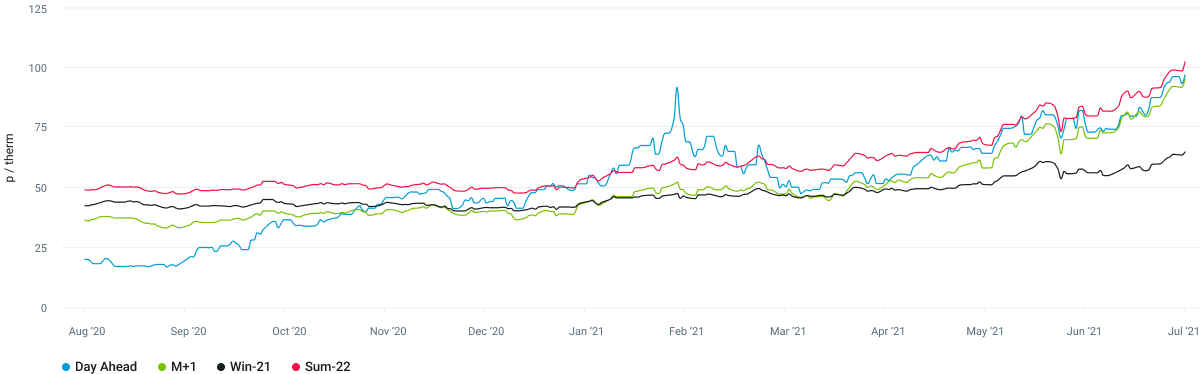

Natural Gas

Bearish fundamentals continued to weigh on prompt gas prices on Tuesday. Seasonally mild weather that is forecast to continue into November, near-full gas storages and steady LNG cargo arrivals remained the bearish drivers although Dutch prices adjusted lower on rising power demand amid weaker winds. With the market having fully factored in Russian supplies the weaker prompt fed into the forward curve with the Nigerian LNG force majeure not impacting prices. Brent briefly traded below $90/bbl as a forecast increase in U.S. shale oil production and the economic slowdown weighed.

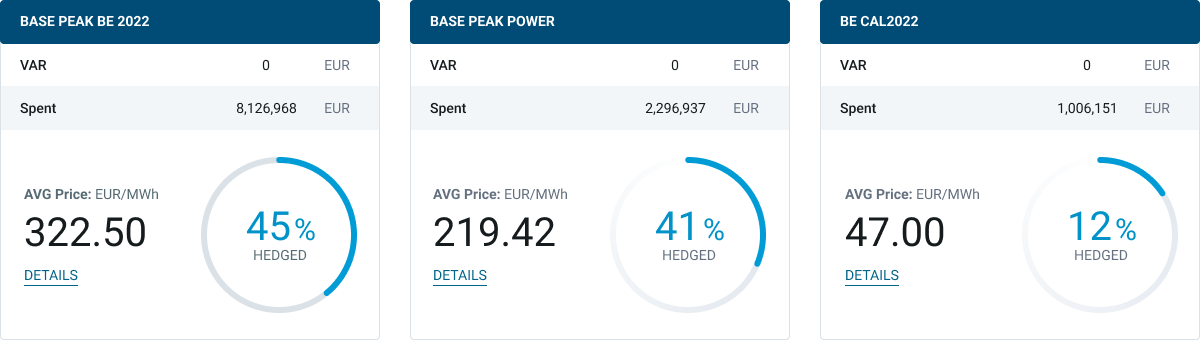

Hedge Reporting